Dont make the mistake so many people make and wait too long to learn more about converting your life insurance policy. Term life insurance conversion if you are looking for multiple quotes on different types of insurance then our insurance quotes service can give you the information you need.

Term Life Insurance Definition

Term Life Insurance Definition

Your 10 year term life insurance policy is coming to an endduring the 9 th year of the level premium period of your term life insurance policy you suffered from a stroke.

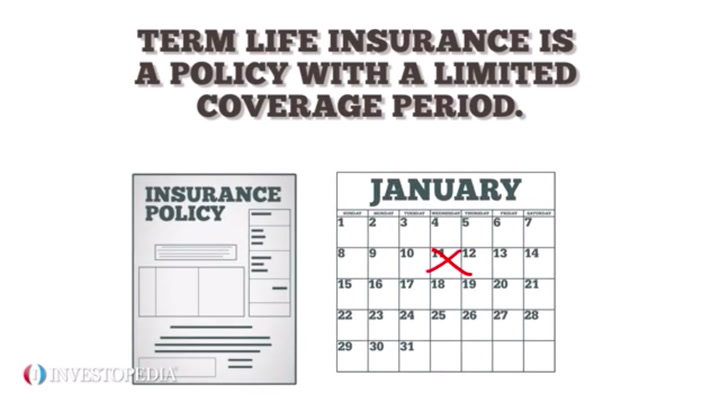

Term life insurance conversion. Almost every term life insurance policy has an option to convert from a term life policy to a permanent policy either whole life or universal life. However its often overlooked and misunderstood. Your term life insurance conversion option is guaranteed even if youve had a change in health.

Instead they let the term life policy lapse and then buy a new term life policy or go without coverage. If you decide you no longer want term life insurance and instead rather have permanent life insurance a term conversion allows for this change. In most cases qualifying for new term life insurance coverage will not be an option due to your high risk to the life insurance company.

You buy term life to cover you for a specific period such as 10 20 or 30 years and your. Term life insurance conversion is one of the most overlooked options of a term policy. What is term life insurance conversion.

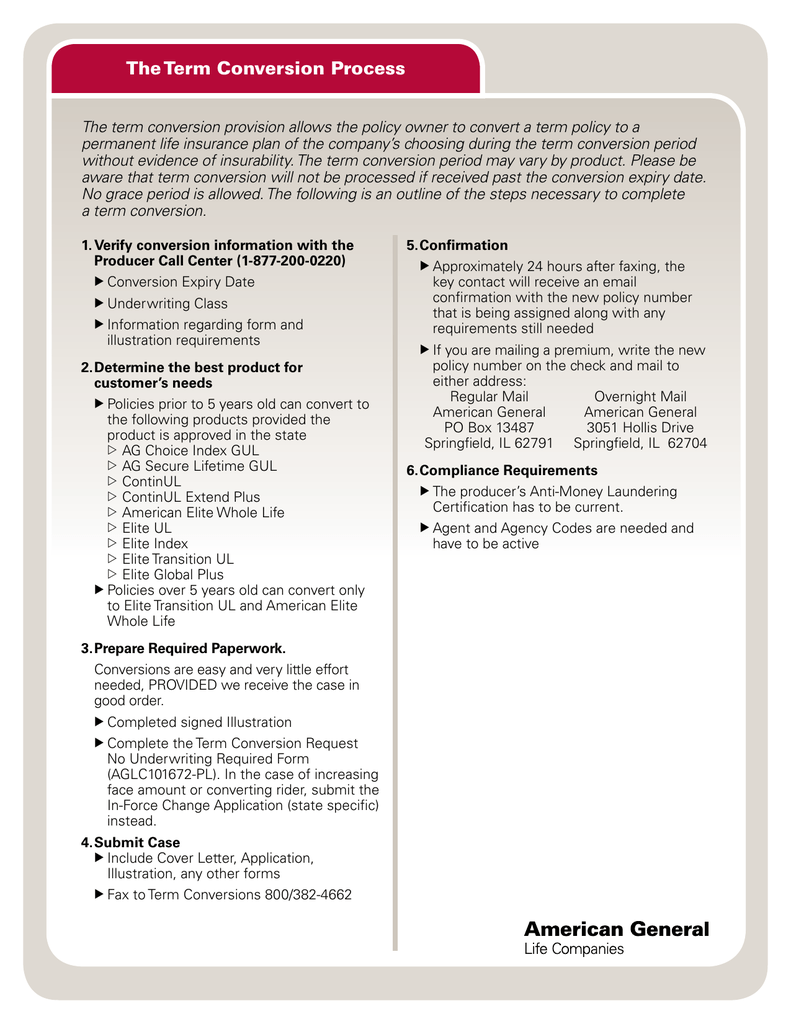

The premiums on the newly converted permanent life insurance policy can often be guaranteed to remain level for the rest of your life. Luckily many term policies provide a life insurance conversion option that enables you to upgrade your policy from term to permanent under the original health rating should the need arise. But what exactly is life insurance conversion and how does it work.

Though most term life plans are convertible most policyholders dont take advantage of it. A term life insurance conversion can be the most important feature to your term life insurance policy. Term conversion options are included in many term life insurance policies for free.

Term life insurance provides affordable temporary coverage which is all many families ever need. For example lets say youre 65 years old and purchased a term life insurance policy 10 years ago. Term life insurance policies are temporary but you can convert to a permanent life policy if you have a convertible term life policy.

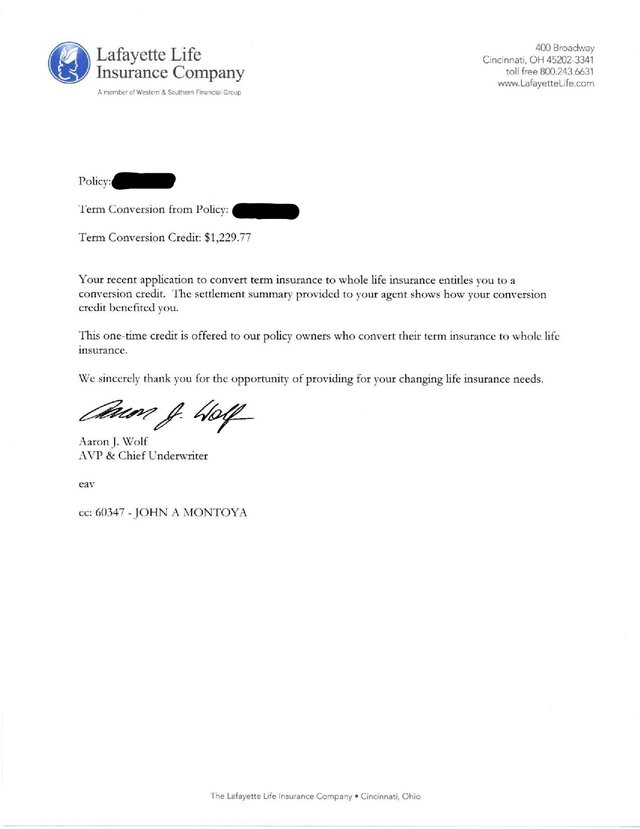

Any unused premiums from your existing policy will be credited towards the new one. Term life insurance conversion if you are looking for a way to find the right insurance plan then our insurance quotes service can give you quotes on different types of insurance. The years in which you can convert and the products you can convert to will vary depending on your specific policy.

Converting Term To Whole Life 6 Reasons To Convert To Whole Life

Converting Term To Whole Life 6 Reasons To Convert To Whole Life

Calameo Li Convertibility Waiver

Calameo Li Convertibility Waiver

What Happens When My Term Life Insurance Policy Ends Quickquote

What Happens When My Term Life Insurance Policy Ends Quickquote

Term Life Insurance Quotes Online Canada Dave Johnson Medium

Term Life Insurance Quotes Online Canada Dave Johnson Medium

Term Life Insurance Conversion Convertible Term Life Insurance

Term Life Insurance Conversion Convertible Term Life Insurance

Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate

7 Myths About Term Life Insurance Conversion Bba Life

7 Myths About Term Life Insurance Conversion Bba Life

Types Of Life Insurance Term Life Vs Whole Life Businessmirror

Types Of Life Insurance Term Life Vs Whole Life Businessmirror

Life Insurance Beneficiary 10 Year Life Insurance Policy

Life Insurance Beneficiary 10 Year Life Insurance Policy

Understanding The Term Conversion Privilege

Understanding The Term Conversion Privilege

Group Life Insurance Conversion And Portability Explained Glg

Group Life Insurance Conversion And Portability Explained Glg

Ssq Term Life Insurance Life Health Invest

Ssq Term Life Insurance Life Health Invest

The Term Conversion Process Estation

The Term Conversion Process Estation

Types Of Term Life Insurance Lifenet Insurance Solutions

Types Of Term Life Insurance Lifenet Insurance Solutions

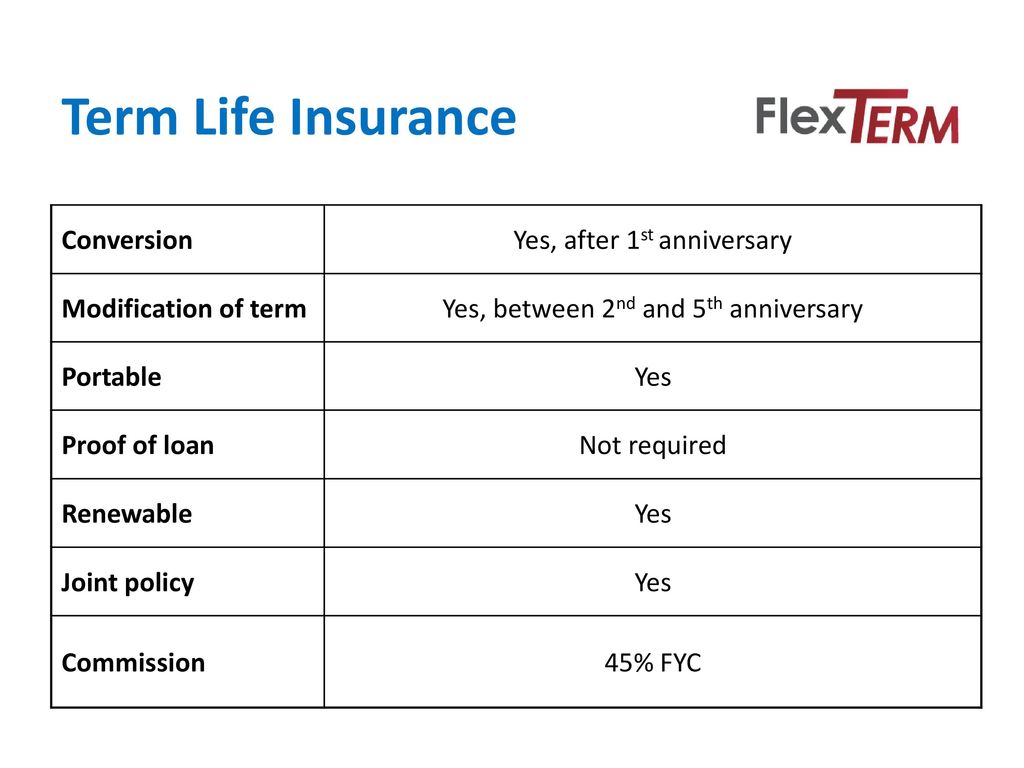

The Better Solution For Your Clients Ppt Download

The Better Solution For Your Clients Ppt Download

When You A Buy Term Life Insurance You Usually Have A Conversion

When You A Buy Term Life Insurance You Usually Have A Conversion

Converting Term To Whole Life Insurance Blog Aig Direct

Converting Term To Whole Life Insurance Blog Aig Direct

The Simple Key To Owning Term Life Insurance Steemit

The Simple Key To Owning Term Life Insurance Steemit

Prudential Life Insurance Review Rootfin

Prudential Life Insurance Review Rootfin

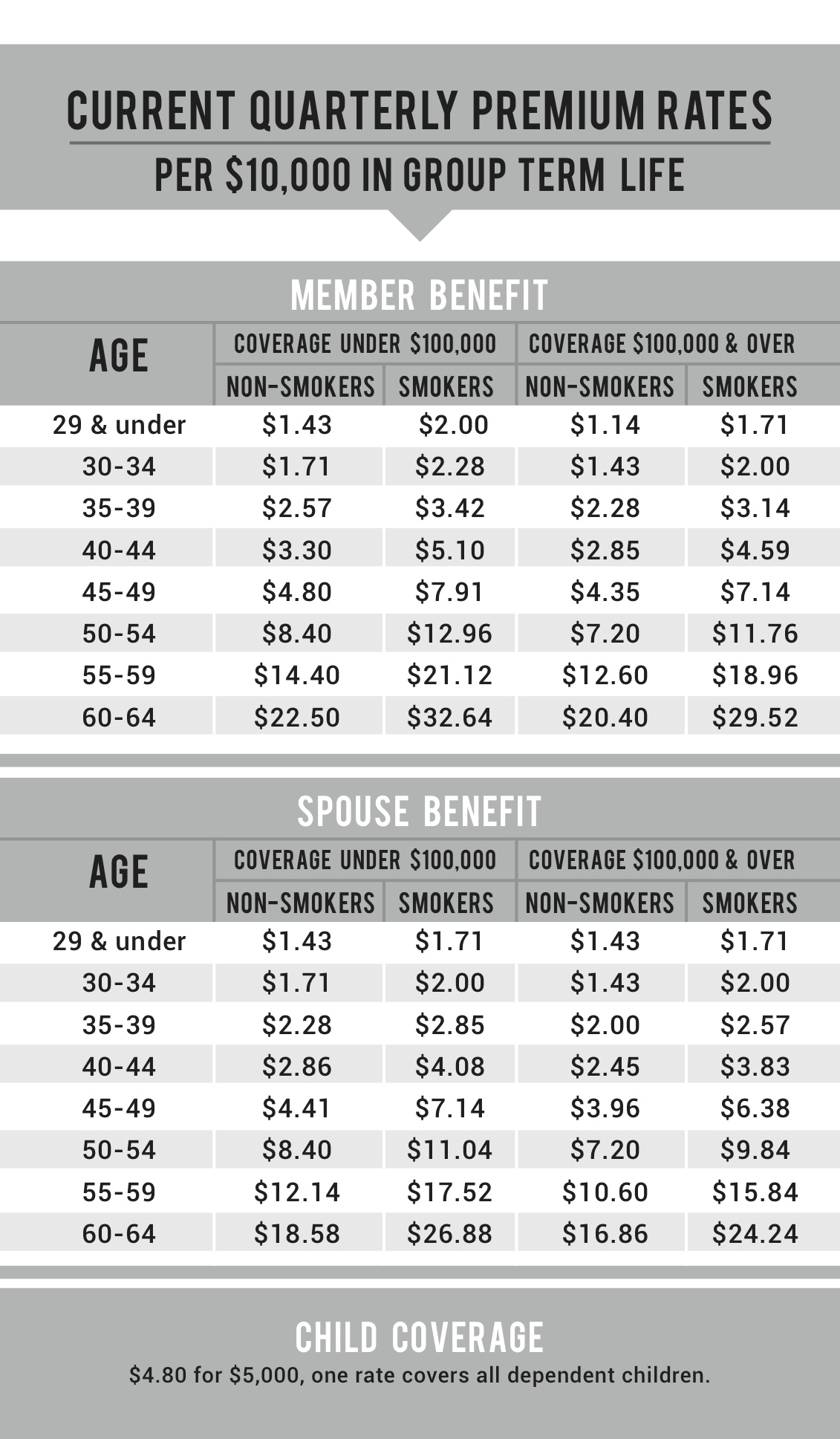

Group Term Life Insurance The Aia Trust Where Smart Architects

Group Term Life Insurance The Aia Trust Where Smart Architects

0 Komentar untuk "Term Life Insurance Conversion"